What we’re seeing this week

This week, Steve and Jo are back with more discussion about this week’s GDT but more importantly the lead up to the latest event. GDT #354 offered limited direction to the wider global dairy market, with limited movement on milk powder prices.

The pair also give a sneak peak on the latest trade updates – with our Trade Insigths due to subscribers later this week – come back next week for a more indepth discussion regarding trade.

Chart of the week

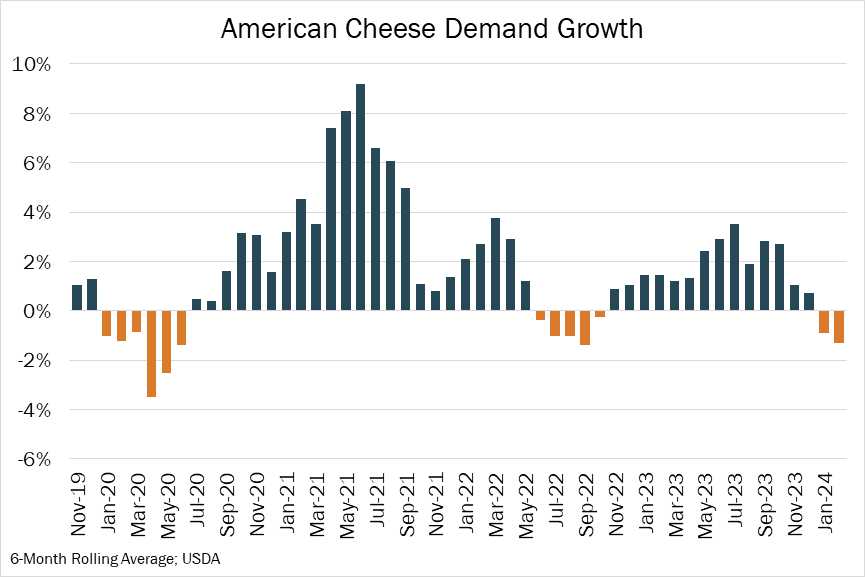

Commercial disappearance of cheese fell 3.5% YOY in February. The overall decrease reflected a 7.3% YOY fall for American cheese varieties, and a 0.7% YOY decline in demand for other cheese varieties (including mozzarella).

Domestic commercial disappearance of butter was down 4.9% YOY for the month but was still 3.7% ahead for the year to date. NFDM demand continued was down 2.9% YOY in February and 5.9% over the last year. The consistently positive trends in domestic commercial disappearance of whey products ended in February – dry whey fell 0.3% YOY while WPC was down 33.4% YOY.